Source:https://www.census.gov/content/dam/Census/library/publications/2014/acs/acsbr13-02.pdf

Source:http://www.singstat.gov.sg/docs/default-source/default-document-library/publications/publications_and_papers/household_income_and_expenditure/pp-s21.pdf

Median Household Income (2013):

US: 52250 USD

Singapore: 7870x12 = 94440 SGD (=74952 USD, USD/SGD=1.26 at the end of 2013) (=68934 USD, USD/SGD=1.37 now)

GNI per Capital

---

系统生成:由于楼层数受限,本帖实际回复的是 daodao 的帖子 “那美国的数据呢?”

原地址:http://bbs.huasing.org/sForum/bbs.php?B=146_13204947

Source:http://quickfacts.census.gov/qfd/states/06/06075.html

---

系统生成:由于楼层数受限,本帖实际回复的是 henryYang 的帖子 “又是城市跟国家比较平均数。。。”

原地址:http://bbs.huasing.org/sForum/bbs.php?B=146_13205038

---

系统生成:由于楼层数受限,本帖实际回复的是 henryYang 的帖子 “又是城市跟国家比较平均数。。。”

原地址:http://bbs.huasing.org/sForum/bbs.php?B=146_13205038

为方便计算,假设美元对新币1.33. 年收入一样US$75000, S$100000.

美国

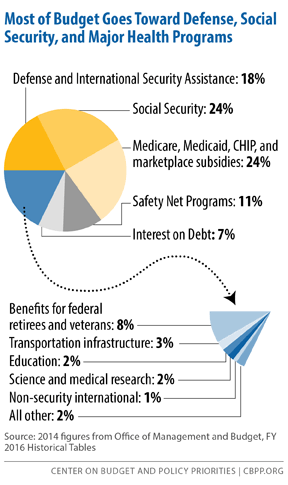

假设一个中上收入的专业人士拿回他交的税的fair share (24% social security + 24% medicare), 那他实际交(11968.75+5737.5)*(1-48%)=9207.25 (S$12245.64). 当然这个假设是不成立的,因为"Social Security benefits are heavily biased towards lower salaried workers"。所以实际上交的税大于9207.25.

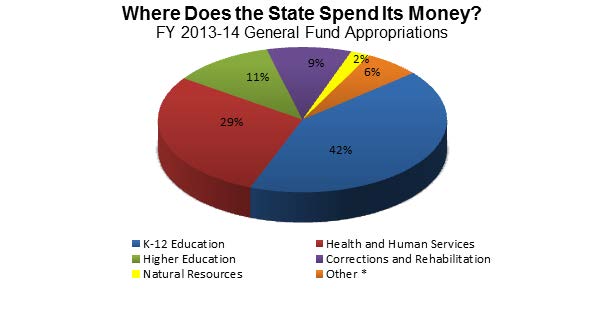

州税大部分用在教育和医疗(82%),假设每人拿回全部没有交州税。

新加坡:

所以在美国比在新加坡至少多交S$ 12245.64-5650=6595.64的税。

---

系统生成:由于楼层数受限,本帖实际回复的是 HMS_Hood 的帖子 “5600 还是多了”

原地址:http://bbs.huasing.org/sForum/bbs.php?B=146_13206769

Huasing Association 1999 - 2013

Huasing Association 1999 - 2013